Currency Trends for July 10th USDCAD Moved Down After Oil

Currency Trends for July 10th USDCAD

Currency Trends for July 10th USDCAD Moved Down After Oil

US non-farm payrolls beat expectations by a wide margin on Friday 7th July 2017, strengthening the US Dollar against the majority of its counterparts, with the exception of Australian and Canadian Dollar. This strong number from US non-farm payrolls has the potential to set the tone for this new trading week.

Japanese Yen

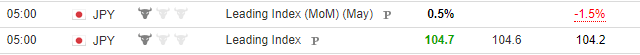

USD/JPYLabor Cash Earnings for the month of May 2017 were higher than expected, with a reading of 0.7% compared to the forecast of 0.4%, while the Leading Index for May was a bit higher than the expectation as it came in 104.7 and the forecast was 104.6.

USD/JPYLabor Cash Earnings for the month of May 2017 were higher than expected, with a reading of 0.7% compared to the forecast of 0.4%, while the Leading Index for May was a bit higher than the expectation as it came in 104.7 and the forecast was 104.6.

These both positive readings are supportive for the Yen, showing increased domestic spending ability and that most economic indicators are positive for the economy. But the Yen depreciated against the US Dollar due to the strong US non-farm payrolls and the USD/JPY moved up 0.59% from 113.07 to 114.19. The weekly gains for USD/JPY were 1.34%, moving from 111.92 to 114.19.

[caption id="attachment_413" align="aligncenter" width="419"]

EURO

The German Industrial Production reading was higher than expected both on a monthly and yearly basis for the month of May, with readings of 1.2% and 5.0% respectively, while their forecasts were 0.2% and 4.0% accordingly. This rising Industrial Production is positive for further economic expansion of Germany and supportive for the Euro. But the forex market was waiting for the main event of the US non-farm payrolls and in this respect the EUR/USD moved down 0.19% from 1.1440 to 1.1378.

The German Industrial Production reading was higher than expected both on a monthly and yearly basis for the month of May, with readings of 1.2% and 5.0% respectively, while their forecasts were 0.2% and 4.0% accordingly. This rising Industrial Production is positive for further economic expansion of Germany and supportive for the Euro. But the forex market was waiting for the main event of the US non-farm payrolls and in this respect the EUR/USD moved down 0.19% from 1.1440 to 1.1378.On weekly basis the EUR/USD fell 0.22% from 1.11440 to 1.1311.

British Pound

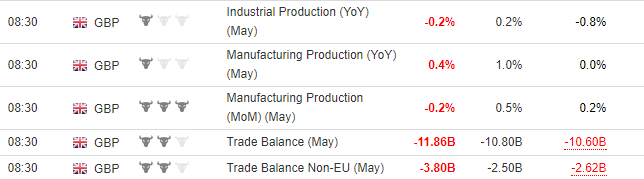

A series of disappointing economic readings for the UK Industrial Production, Manufacturing Production and Construction Output for the month of May, plus a higher than expected Visible Trade Balance deficit were all negative for the British Pound and as a result the Pound depreciated significantly against the US Dollar. These week economic readings must be closely monitored and analyzed on a monthly basis as they can provide important information about the Brexit effects on the UK economy in terms of economic growth, inflation and the possibility of an interest rate change.

A series of disappointing economic readings for the UK Industrial Production, Manufacturing Production and Construction Output for the month of May, plus a higher than expected Visible Trade Balance deficit were all negative for the British Pound and as a result the Pound depreciated significantly against the US Dollar. These week economic readings must be closely monitored and analyzed on a monthly basis as they can provide important information about the Brexit effects on the UK economy in terms of economic growth, inflation and the possibility of an interest rate change.[caption id="attachment_416" align="aligncenter" width="445"]

The GBP/USD moved down 0.61% from 1.2977 to 1.2864. On weekly basis there were losses for the pair as well of about 1.04% as the pair moved down from 1.3026 to 1.2864.

Swiss Franc

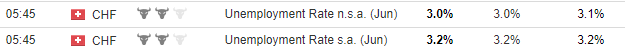

The Swiss Unemployment reading came in exactly as the forecast at 3.0% for the month of June, a neutral reading. But due to the strong US non-farm payrolls the gold prices fell almost 1.11%, and in turn the Swiss Franc depreciated against the US Dollar.

The Swiss Unemployment reading came in exactly as the forecast at 3.0% for the month of June, a neutral reading. But due to the strong US non-farm payrolls the gold prices fell almost 1.11%, and in turn the Swiss Franc depreciated against the US Dollar.[caption id="attachment_417" align="aligncenter" width="449"]

The USD/CHF moved up moderately, with gains of 0.35%, from 0.9599 to 0.9656. On weekly basis the gains for USD/CHF were 0.59% as the pair from 0.9579 to 0.9689.

Canadian Dollar

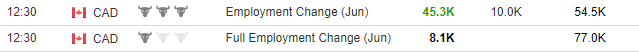

A very strong Net Change in Employment for the Canadian economy with a reading of 45.3k against the forecast of 10.0k for the month of June and a small decline in the Unemployment Rate with a reading of 6.5%, lower than the forecast of 6.6%, were both very positive for the Canadian Dollar. The Canadian Dollar had strong gains against the US Dollar, as the USD/CAD moved lower 0.79% from 1.2995 to 1.2857.

A very strong Net Change in Employment for the Canadian economy with a reading of 45.3k against the forecast of 10.0k for the month of June and a small decline in the Unemployment Rate with a reading of 6.5%, lower than the forecast of 6.6%, were both very positive for the Canadian Dollar. The Canadian Dollar had strong gains against the US Dollar, as the USD/CAD moved lower 0.79% from 1.2995 to 1.2857.[caption id="attachment_418" align="aligncenter" width="458"]

There was also a strong selloff for the oil prices, about 2.83% which did not have any negative impact for the USD/CAD. The forex market now may focus on the possibility of an interest rate hike on Wednesday 12th July 2017 from the Bank of Canada. On weekly basis the Canadian Dollar appreciated against the US Dollar as the USD/CAD moved down 0.69% from 1.3016 to 1.2857.

NOTE: This article is not an investment advice. Any references to historical price movements or levels is informational and based on external analysis and we do not warranty that any such movements or levels are likely to reoccur in the future.

No hay comentarios.: